In today’s increasingly interconnected and digitized world, financial fraud presents a significant challenge for businesses, particularly in B2B transactions. With a rapidly evolving digital landscape, fraudsters are employing sophisticated tactics to exploit vulnerabilities, putting organizations of all sizes at risk. The consequences of financial fraud can be severe, affecting a company’s return on investment (ROI), draining valuable resources, and tarnishing its brand reputation.

The latest AFP Payments Fraud and Control Survey Report from JPMorgan underscores this growing problem. It reveals that a staggering 84% of businesses with revenues exceeding $1 billion and maintaining over 100 payment accounts experienced either attempted or actual fraud within the past year. This alarming statistic highlights that the threat of financial fraud is not confined to corporate giants; it transcends boundaries and impacts organizations regardless of their size. Among smaller entities, 65% of companies surveyed acknowledged their ongoing battle with B2B payment fraud, demonstrating that this issue is universal.

As businesses increasingly adopt digital methods for transactions, the complexity of financial fraud schemes has risen dramatically. Techniques such as Business Email Compromise (BEC) are particularly troubling. BEC schemes involve the unauthorized access of business email accounts to manipulate and redirect financial transactions, exposing companies to substantial losses. The FBI has reported a staggering total of 50 billion lost to BEC from 2013 through 2022, with the Internet Crime Complaint Center (IC3) noting that 2.7 billion was lost specifically to BEC incidents in 2022 alone.

Fraudsters employ various methods to propagate their schemes, including phishing, spoofing, and social engineering, which have all proven devastatingly effective. These tactics harness psychological manipulation, technical deception, and exploitation of trust, leading to billions of dollars in losses annually.

In this landscape, innovative solutions are essential. Sardine.ai emerges as a pioneering force in the financial fraud prevention domain, leveraging advanced artificial intelligence tools to safeguard businesses against these rising threats. By utilizing cutting-edge technology, Sardine.ai aims to mitigate risks and fortify financial transactions, ensuring that organizations can operate confidently in an increasingly perilous environment.

Current Trends in Financial Fraud

The landscape of financial fraud is evolving at an alarming rate, characterized by increasingly sophisticated methods that exploit technological advancements and human vulnerabilities. Recent statistics paint a grim picture of the rising tide of fraud cases. According to the 2023 AFP Payments Fraud and Control Survey Report, a notable surge in fraud incidents has been observed, with 77% of organizations reporting attempts at fraud. BEC schemes, in particular, have gained traction, accounting for a significant portion of these attempts. Cases of invoice fraud and false payment requests are also on the rise, showcasing the creativity of fraudsters in manipulating digital communications.

One notable example of this shift occurred with an international manufacturing firm that became a victim of a BEC scam. The company was tricked into sending a substantial payment to an account controlled by fraudsters who had impersonated a trusted vendor through email. This incident not only resulted in a direct financial loss but also sparked a chaotic investigation, drawing resources away from the company’s core operations. As technological resources expand, fraudsters consistently adapt, utilizing social engineering tactics, AI-generated impersonation, and deepfake technologies to deceive unsuspecting employees.

Consequences of Financial Fraud for Businesses

The ramifications of financial fraud extend far beyond immediate monetary losses, impacting businesses financially, operationally, and reputationally. Financially, companies face potential losses that can cripple their operations; small and medium-sized enterprises (SMEs) report that a single fraudulent incident can result in losses reaching tens of thousands or even millions of dollars, depending on the scale of the fraud.

Operationally, the consequences can be debilitating. Resources that could be allocated to growth and innovation are redirected towards investigations, recovery efforts, and compliance with regulatory requirements. For example, a well-known financial services firm faced considerable operational upheaval after suffering a data breach linked to fraudsters. The resulting investigation took months and significantly drained human and financial resources, hindering the firm’s ability to serve its clients effectively.

Reputationally, the cost of fraud can be incalculable. Trust is foundational in business relationships, and a single incident can damage a company’s credibility. A prime illustration is the case of a technology company that fell victim to a large-scale fraud scheme; following the incident, the company faced a significant decline in customer trust, leading to a drop in stock price and loss of key clients. As customers became wary of potential vulnerabilities, the firm struggled to regain its market position.

Sardine.ai boasts a suite of key features that collectively fortify its position as a leader in financial fraud prevention, ensuring comprehensive protection against various forms of fraud:

Real-Time Risk Decisioning

Sardine.ai automates risk assessments proactively, assessing transactions and user behaviors in real-time. This feature allows businesses to make instantaneous decisions about potential risks, effectively reducing the window of opportunity for fraudsters.

Modular Building Blocks

The platform’s modular architecture allows it to address a wide range of fraud-related challenges through specialized components:

Device and Behavior

- The platform employs proprietary device intelligence and biometric analysis to detect suspicious behaviors. For instance, it recognizes irregular mouse movements or the use of virtual private networks (VPNs) during account creation and login, thereby enhancing security measures and reducing fraud risk.

Identity Fraud

- The platform identifies and prevents identity fraud by analyzing behavioral patterns from users. It flags synthetic or stolen identities in real-time, preventing unauthorized access and financial loss.

Payment Fraud

- The platform continuously monitors transactions for anomalies indicative of payment fraud. This proactive approach significantly reduces chargebacks and ensures that only verified transactions are approved.

Bank Account Validation

- The platform validates bank accounts to confirm that they are not associated with fraudulent activities prior to processing transactions, safeguarding financial flows.

Card Issuing Fraud

- The platform protects financial institutions from fraud during the card issuance process by detecting patterns that are typical of fraudulent applications, ensuring a safer onboarding process.

Chargeback Guarantee

- The platform provides coverage for chargebacks on transactions flagged by its detailed analytics, minimizing financial losses for banks and enhancing operational stability.

Merchant Acquiring OS

- The platform optimizes risk management practices for acquiring merchants by ensuring that only trustworthy entities are onboarded, thus maintaining a secure merchant ecosystem.

KYC and KYB

- The platform streamlines Know Your Customer (KYC) and Know Your Business (KYB) processes, delivering essential insights that allow banks to verify customer identities efficiently and effectively.

AML Compliance

- The platform implements real-time Anti-Money Laundering (AML) monitoring to detect potential money laundering activities across transactions, helping banks remain compliant with stringent regulations.

Through these robust features, Sardine.ai equips businesses with the tools needed to navigate the complex and evolving landscape of financial fraud, protecting their interests and fostering a secure transactional environment.

Modular Approach to Risk Management

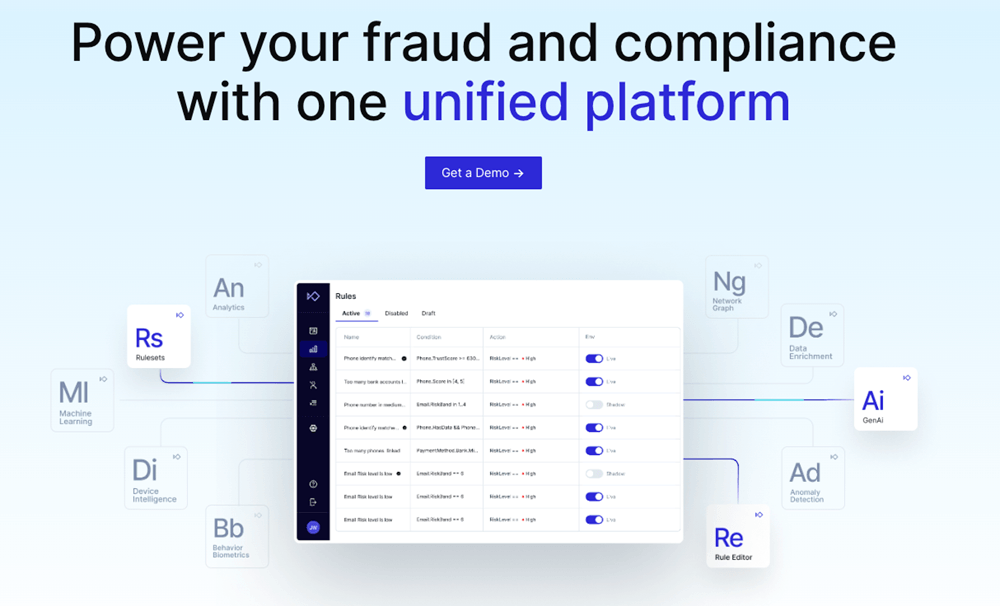

Sardine.ai represents a transformative step in the realm of financial fraud prevention by empowering businesses to adopt a modular approach to risk management. This innovative framework allows organizations to consolidate multiple vendors into a single, streamlined solution, significantly enhancing operational efficiency. Traditionally, businesses often struggled with disparate systems, each addressing different aspects of fraud, resulting in inefficiencies, communication breakdowns, and increased overhead costs.

By utilizing Sardine’s AI fraud prevention software platform, organizations can simplify their fraud prevention efforts, minimizing the complexity of vendor management and reducing the risk of gaps in their security measures. The modular architecture not only facilitates tailored solutions that address specific needs but also optimizes resource allocation, allowing businesses to focus their efforts and budgets where they are needed most. This consolidation enhances responsiveness, as real-time insights and data flow seamlessly through a unified interface, enabling quicker and more informed decision-making. Thus, Sardine.ai not only boosts efficiency but also strengthens an organization’s overall defense against the multifaceted threat of financial fraud.

Data-Driven Insights

In the fight against financial fraud, data-driven insights play a pivotal role, and Sardine.ai harnesses the power of artificial intelligence (AI) and machine learning to achieve this. By analyzing vast amounts of transaction data, behavioral patterns, and contextual information, the platform identifies anomalies and emerging trends that indicate potential fraudulent activity. Advanced algorithms are designed to learn from real-time data inputs, continuously refining their detection capabilities to adapt to the evolving tactics employed by fraudsters.

The continual monitoring enabled by Sardine.ai is vital for staying ahead of fraudsters. Traditional methods often fall short because they rely on static rules that can quickly become outdated. In contrast, Sardine.ai’s adaptive learning mechanisms ensure that the system evolves with each detected fraud attempt, allowing it to recommend updated strategies to safeguard financial transactions. By maintaining a proactive stance, organizations can significantly reduce the likelihood of successful fraud attempts, protecting their assets and preserving customer trust.

FRAML Success Stories

The impact of Sardine.ai’s innovative solutions is best illustrated through the success stories of its customers, who have experienced significant reductions in chargebacks and overall fraud. One noteworthy example is Novo, a financial technology company that realized an astounding 90% reduction in chargebacks after implementing Sardine.ai’s comprehensive fraud management platform. By utilizing Sardine.ai’s advanced features—such as real-time risk decisioning, device intelligence, and anomaly detection—Novo transformed its approach to fraud prevention, leading to enhanced operational efficiency and improved customer satisfaction.

Customers have consistently praised Sardine.ai for its ability to simplify risk management processes and provide actionable insights that empower teams to make informed decisions. Testimonials highlight not only the financial benefits of reduced chargebacks but also the peace of mind that comes with knowing robust, intelligent systems are in place to safeguard their operations. As more businesses share their successes, it becomes clear that Sardine.ai is not just a tool but a partner in the ongoing battle against financial fraud.

Broader Industry Impact

The implementation of advanced tools like Sardine.ai extends far beyond individual companies; it signals a broader industry shift towards better compliance and a significant reduction in financial crime across sectors. As organizations adopt AI-driven fraud prevention strategies, the collective impact can lead to enhanced trust in digital transactions and greater resilience in the face of evolving threats.

Industries ranging from banking to e-commerce benefit from improved compliance with regulatory standards as Sardine.ai systematically enforces Known Your Customer (KYC) and Anti-Money Laundering (AML) requirements through its integrated processes. By enabling real-time monitoring and analysis, businesses can swiftly respond to suspicious activities, effectively curbing potential financial crimes before they escalate.

Moreover, the adoption of such advanced tools fosters collaboration within industries as organizations share insights and best practices gleaned from their experiences using platforms like Sardine.ai. This collaborative environment promotes a culture of vigilance and proactive fraud prevention, ultimately contributing to safer transaction ecosystems.

Strengthening Your Business Against Financial Fraud

In today’s increasingly complex digital landscape, the necessity of implementing robust fraud prevention measures has never been more critical for businesses of all sizes. Financial fraud not only poses a direct threat to an organization’s bottom line but also jeopardizes customer trust and brand reputation. To combat these challenges effectively, businesses must adopt comprehensive and innovative solutions tailored to their unique needs.

Sardine.ai stands out as a pioneering platform that empowers organizations to tackle financial fraud through its advanced technology and real-time risk assessment capabilities. By consolidating multiple fraud prevention tools into a single, streamlined solution, Sardine.ai enhances operational efficiency while safeguarding financial transactions against an array of fraudulent tactics.

We invite you to explore the comprehensive solutions offered by Sardine.ai to protect your business from the ever-evolving threats of financial fraud. Experience firsthand how this state-of-the-art financial fraud prevention platform can safeguard your financial operations by scheduling a demo today. Together, let’s fortify your defenses and ensure the security of your business in a digital world.