In today’s increasingly regulated business environment, ensuring compliance with both external rules and internal policies is paramount. Every industry, especially healthcare and finance, faces unique challenges that can complicate compliance efforts and increase risk exposure. This is where process mining can play a transformative role. By leveraging data and technology, process mining provides a comprehensive understanding of organizational workflows, enabling firms to optimize compliance and minimize risks. This article explores how process mining redefines compliance and risk management, fostering more rational and data-driven decision-making.

Understanding Process Compliance

Process compliance refers to the adherence of organizational processes to established norms, regulations, and internal guidelines. It is crucial for ensuring that business operations align with legal, regulatory, and organizational requirements.

Types of Compliance

- Regulatory Compliance: Adherence to laws and regulations set by governing bodies, such as GDPR for data protection or SOX for financial reporting.

- Legal Compliance: Ensuring business operations do not violate legal frameworks, including labor laws and anti-corruption statutes.

- Financial Compliance: Managing financial resources to achieve corporate goals while adhering to financial regulations.

- Data Compliance: Protecting against data breaches and ensuring compliance with data protection regulations to safeguard client privacy.

Common Issues with Process Compliance

- Dynamic Rules: Navigating the complexity of evolving rules and regulations across different jurisdictions.

- Process Complexity: Managing intricate workflows involving multiple departments and systems.

- Data Silos: Integrating separate data sources to obtain a holistic view of processes.

- Human Errors: Reducing the risk of manual errors through automation.

Importance of Process Compliance Across Industries

- Banking: Ensures accurate reporting and compliance with anti-money laundering (AML) regulations.

- Insurance: Facilitates compliance with claims processing and risk assessment regulations.

- Healthcare: Secures patient data and ensures compliance with health standards such as HIPAA.

- Manufacturing: Maintains product quality and compliance with safety regulations.

What is Process Mining?

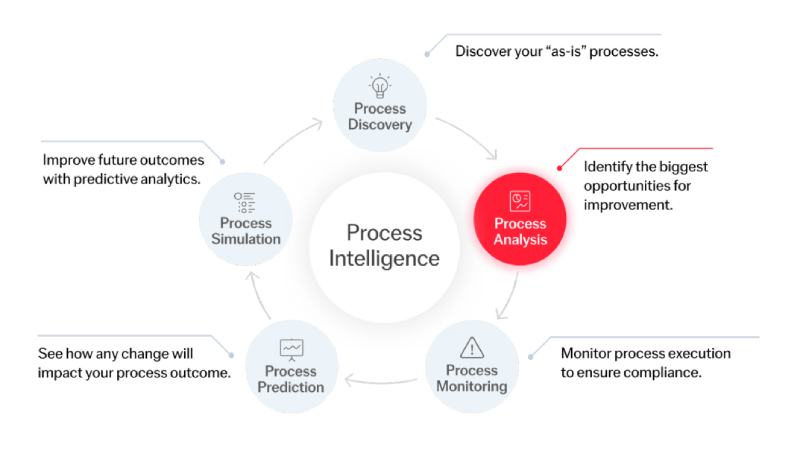

Process mining uses data mining techniques to analyze event logs from systems of record, providing an objective view of how processes are actually implemented and running. This approach helps organizations explore, monitor, and enhance their business processes.

How Does Process Mining Work?

- Data Extraction: Event logs are extracted from enterprise systems such as ERP, CRM, and BPM tools.

- Process Discovery: Algorithms analyze data to reconstruct actual workflows, creating a visual process map.

- Conformance Checking: The reconstructed workflow is compared against a predefined model to identify deviations and bottlenecks.

- Process Enhancement: Insights gained from the analysis are used to optimize processes, reduce inefficiencies, and ensure compliance.

Benefits of Using Process Mining for Compliance

- Enhanced Transparency: Provides a clear view of actual processes, uncovering hidden inefficiencies and deviations from compliance standards.

- Automated Audits: Streamlines compliance audits by automatically identifying process anomalies and non-conformities.

- Proactive Risk Mitigation: Tracks potential threats early, allowing for proactive risk management.

- Data-Driven Decisions: Offers valuable insights for implementing strategies based on the latest data.

Real-World Applications of Process Mining in Risk Management

- Financial Institutions: Banks use process mining to identify inefficiencies in loan processing while adhering to regulatory timelines.

- Healthcare: Hospitals apply process mining to optimize patient discharge workflows, ensuring compliance with health and safety standards.

- Retail: Retailers analyze supply chain operations to ensure compliance with environmental and labor laws.

- Insurance: Insurance companies optimize claims processing systems to reduce fraud and comply with regulatory frameworks.

The Future of Process Compliance and Risk Management with Process Mining

As technology advances, process mining will become central to compliance and risk management strategies. Future developments include:

- AI-Powered Insights: Integrating process mining with artificial intelligence for risk prediction and corrective action recommendations.

- Integration with Emerging Technologies: Enhancing process mining capabilities through integration with IoT, blockchain, and cloud computing.

- Advanced Visualization Tools: Developing more intuitive and interactive dashboards for better decision-making.

- Industry-Specific Solutions: Creating customized process mining applications tailored to the compliance challenges of various industries.

- Continuous Assessment: Monitoring ongoing operations for process anomalies and providing real-time issue notifications and automatically recommending corrections.

Conclusion

Process mining is revolutionizing compliance and risk management by incorporating a real-time, data-driven, transparent, and proactive approach. It not only reveals inefficiencies and risks but also ensures adherence to organizational standards, helping businesses stay ahead of increasingly complex regulations. As industries continue their digital transformation, process mining will remain a cornerstone for smarter, more efficient, intelligent compliance.