Lawsuits Over Innovation: The Winklevoss Way to Wealth

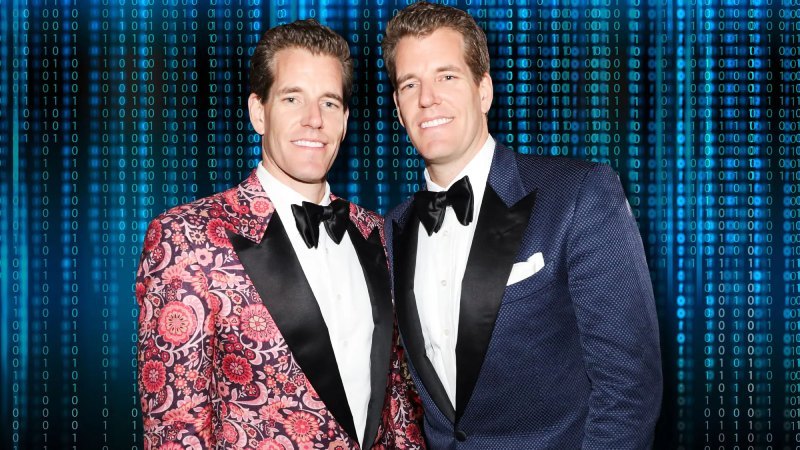

The Winklevoss twins – Cameron and Tyler – have long been hailed as “Bitcoin billionaires,” but their path to fortune stands in stark contrast to the libertarian, innovative spirit that defined many early Bitcoin adopters. Unlike the cypherpunks and rebel entrepreneurs who built or championed Bitcoin in its infancy, the Winklevoss brothers didn’t earn their wealth by creating breakthrough technology or embracing radical free-market ideals. Instead, they built their wealth primarily through litigation and courtroom battles, not innovation. Their saga famously began with suing Facebook’s Mark Zuckerberg over a social network idea – a legal battle that won them a $65 million settlement (including stock) in 2008.

Tellingly, rather than channeling entrepreneurial ingenuity, they doubled down on lawsuits: after the settlement, they tried (and failed) to sue Zuckerberg again, then even sued their own lawyers. Litigation wasn’t just a footnote in their story; it was the foundation of their fortune. This litigious reputation would follow them into the Bitcoin world, coloring their approach to crypto. In Silicon Valley, the twins struggled to find partners willing to work with them – unsurprising, perhaps, given their reputation for suing talented programmers at the first sign of trouble. While others in the Bitcoin universe were writing code or launching startups on shoestring budgets, the Winklevosses’ instinct was to lawyer up and cash in.

Shunning the Cypherpunk Ethos

Early Bitcoin enthusiasts were often hardcore libertarians and cypherpunks – dreamers and doers who saw Bitcoin as a tool to disrupt the state-led financial system. These pioneers valued privacy, open-source innovation, and a radical distrust of authority. Many were inspired by the Cypherpunk Manifesto and the ideals of cryptographic freedom. They built exchanges in their garages, corresponded on cryptography mailing lists, and viewed Bitcoin as more than an investment: it was a social revolution.

The Winklevoss twins, however, never truly fit into this ideological mold. They entered the Bitcoin scene with business suits and regulatory ambitions, not Guy Fawkes masks or anarchist leanings. After their big Facebook payout, the twins bought into Bitcoin (reportedly amassing around 1% of all BTC) and started showing up at Bitcoin conferences – yet their style of “evangelism” was markedly different. They weren’t writing manifestos or developing new tech; instead, they were taking private jets to meetings and mingling with celebrities in an effort to brand themselves as crypto visionaries. Meanwhile, Bitcoin’s value in those early years wasn’t skyrocketing because of anything the Winklevosses did – it was largely because Bitcoin offered a way to buy things anonymously on the internet (often illegal things), fulfilling the cypherpunk dream of uncensorable money.

Perhaps the clearest illustration of their disconnect from Bitcoin’s libertarian ethos is their attitude toward rules and authority. While early crypto adopters often chafed at any regulation – seeing Bitcoin as a means to escape banks and governments – the Winklevoss twins actively courted regulators. They famously launched a marketing campaign in early 2019 proclaiming “Crypto Needs Rules,” a slogan that outraged Bitcoin purists who believed the whole point of cryptocurrency was to avoid the heavy hand of regulation. Tyler Winklevoss acknowledged that a “narco-libertarian bent” has existed in crypto since day one, referring to the strong anti-regulation, anti-government strain in the community. But rather than join that strain, the twins set out to “tame” Bitcoin – to make it palatable to Wall Street and traditional finance.

Silent on Silk Road and Ross Ulbricht

Nothing demonstrates the Winklevoss’ lack of libertarian cred more than their stance (or lack thereof) on Silk Road and its imprisoned founder, Ross Ulbricht. In Bitcoin’s early history, Silk Road loomed large. This online black marketplace, run on Bitcoin, was the pure manifestation of Bitcoin’s libertarian potential and peril – a free market beyond government reach. To many early adopters, Ulbricht (known by his alias “Dread Pirate Roberts”) became a sort of folk hero or martyr. Libertarians lauded Silk Road as an “innovation” in voluntary free trade, arguing it cut out the violence of the drug trade by moving it online.

When Ulbricht was arrested and later sentenced to an unprecedented double life sentence for his role, outcry erupted from the crypto-libertarian community. Prominent Bitcoin figures – from Roger Ver to early developers and investors – voiced public support for Ulbricht, calling his punishment draconian and rallying behind the hashtag #FreeRoss. They donated to his legal defense, penned open letters, and highlighted the injustice of a non-violent first-time offender being condemned to die in prison. Supporting Ross Ulbricht became, in a sense, a litmus test for how committed one was to Bitcoin’s anti-authoritarian roots.

The Winklevoss twins, however, were conspicuously quiet. Throughout Ulbricht’s trial and sentencing in 2013-2015, the twins offered no public support or sympathy for the man who had, ironically, helped drive Bitcoin’s early utility and value. While others in their milieu were taking principled (if controversial) stands in defense of Silk Road’s philosophy, the Winklevosses kept their distance. They did not join calls for leniency or question the morality of Ulbricht’s sentence. This silence spoke volumes: the twins were eager to distance themselves from Bitcoin’s outlaw image. Silk Road’s libertarian experiment may have validated Bitcoin’s potential, but it was a public relations nightmare for anyone trying to bring cryptocurrency into the mainstream. And mainstream acceptance – not ideological purity – was clearly the twins’ priority.

Embracing the Establishment, Not the Revolution

While true Bitcoin libertarians were busy challenging central banks and celebrating the notion of being one’s own bank, the Winklevoss twins were busy trying to become the bankers of Bitcoin. The difference in mindset could not be starker. Many early Bitcoiners imagined a future where individuals could transact freely, without surveillance or middlemen. The Winklevosses, by contrast, imagined a future where Bitcoin would slot neatly into the existing financial order – a new asset class for the Wall Street elite, with the twins as gatekeepers. They aggressively pursued projects like the first Bitcoin ETF (Exchange-Traded Fund) to further blend crypto with traditional finance.

The twins’ actions and statements consistently prioritized legitimacy over liberty. They invited federal regulators to scrutinize their exchange, obtained government licenses, and spoke about Bitcoin’s potential mainly in terms of investment opportunity and financial innovation (within the system) rather than personal freedom or privacy. In a movement about decentralization and freedom, the Winklevoss twins stood out by siding with centralization and control whenever it suited their interests. They were early Bitcoiners, yes, but they actually weren’t libertarians unlike almost everybody else at the time.