New ways of investing, borrowing, and managing money are opening up thanks to changes we couldn’t have imagined a few years ago. Almost half of financial institutions are rethinking how they work to keep up with these changes.

So, what are these changes reshaping the financial world? And what can we expect to see next?

Let’s take a closer look at 10 key trends that are shaping the future of finance in 2025.

#1. Tokenized Assets Revolution

Tokenized assets are set to make a huge impact in 2025, and they’re changing the way people think about investing. Thanks to blockchain technology, real-world assets like real estate, stocks, and even art can now be divided into smaller, digital pieces called tokens, says Dan Close, Founder and CEO of BuyingHomes.com.

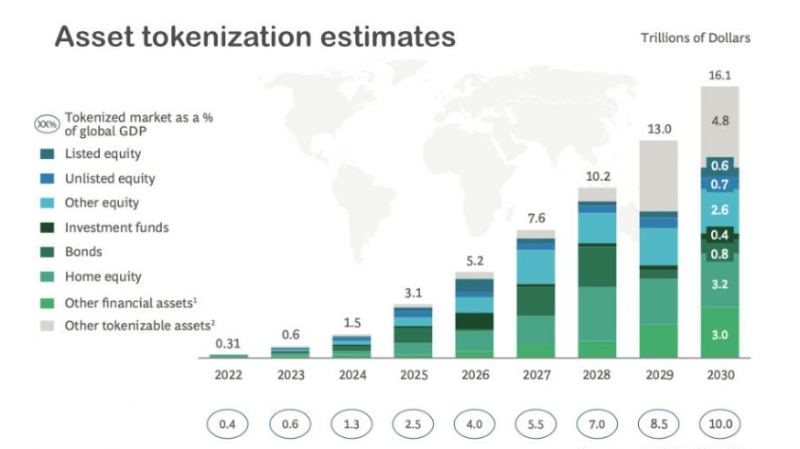

Image Source: Ledger Insights

As you can see in the above image, the tokenized asset market could reach $16 trillion by 2030. This shift might change the way people think about investments by breaking down large assets into smaller, digital portions through tokenization.

For example, instead of needing a large amount of money to purchase an entire property, tokenization might allow someone to own a small portion. This approach makes investing more accessible and provides greater liquidity, enabling transactions to happen faster compared to the traditional, often time-consuming processes.

According to Jeremy Hoye, Business Owner of Jeremy Hoye Jewellery, “Businesses might use tokenization to raise funds in a more streamlined way, potentially reaching a broader audience without the complexities of traditional financing methods.”

#2. AI-Driven Risk Assessment

AI is becoming an important tool for businesses to manage financial risks. Companies like JPMorgan Chase and HSBC are using AI to analyze large amounts of data and identify risks early, helping them make better decisions.

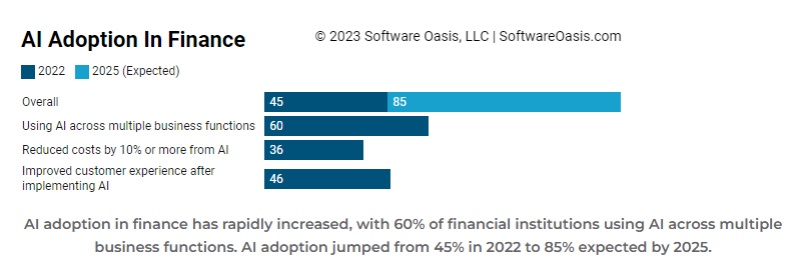

In the below image you can see how AI in finance is growing quickly.

Image Source: Software Oasis

This shows how useful this technology is becoming.

AI tools can study market trends, find patterns, and understand how global events might affect investments. These tools don’t replace traditional methods but work alongside them to provide better insights and faster responses. This might help businesses prepare for potential risks and take action more efficiently, says Aaron Dewit, Owner of Commercial Cleaning Depot.

#3. Rise of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are becoming a reality, with 134 countries and currency unions, representing 98% of global GDP, now exploring CBDCs. Back in May 2020, only 35 countries were considering this technology, but the number has grown significantly. Currently, 66 countries are in advanced stages, including development, pilot programs, or full-scale launches, which signal strong momentum as we move toward 2025.

And China tops the list. They have already made great progress with its digital yuan, which is being used in cities and even large-scale events.

Image Source: Global Times

Countries like India and Sweden are also testing their own versions, with pilot programs expanding quickly.

CBDCs are digital versions of a nation’s currency, issued by central banks. Unlike cryptocurrencies, they are fully backed by governments, offering stability and trust. These initiatives aim to make payments faster, reduce costs, and improve security for individuals and businesses, says James Forsyth, ICAEW Chartered Accountant at Quality Contracts.

For example, international transfers that typically take days might be processed much faster with CBDCs. Businesses could potentially benefit from lower transaction fees, while governments may find it easier to improve oversight, reduce fraud, and track financial activities more effectively.

These currencies also have the potential to help individuals without access to traditional banking services. With a smartphone and a digital wallet, people might be able to store and use money securely. This can be particularly useful in regions where access to banking services is currently limited.

#4. Micro-Investments Surge

Per Markus Åkerlund, CEO of MEONUTRITION says, “Micro-investments are gaining popularity, especially among younger investors like Gen Z and Millennials. These small investments allow individuals to start building their portfolios without needing a significant amount of money upfront.” Platforms like Robinhood, Acorns, and Stash provide accessible ways to invest minimal amounts into stocks, funds, or even real estate.

Let’s say you buy a coffee for $3.40, Acorns rounds it up to $4.00 and invests the extra $0.60 for you.

These small contributions happen in the background, helping you grow your savings without even noticing. Over time, these little amounts build into something great for your future.

In the past, many believed they needed thousands of dollars to begin, but micro-investing lowers that barrier. It might also provide a way to diversify investments, which can reduce risk and create opportunities to grow wealth over time.

A study shows the global micro-investing platform market is projected to grow from USD 666 million in 2024 to USD 2,863.67 million by 2032. That means, we can see more opportunities in 2025.

#5. AI-Driven Personal Finance Advisors

AI-driven personal finance advisors are becoming a useful tool for managing money. These tools use algorithms to offer advice on saving, budgeting, and investing based on your financial goals and spending habits. The AI in Fintech Market is estimated to grow from USD 14.79 billion in 2024 to USD 43.04 billion by 2029, at a CAGR of 23.82%, showing the increasing demand for AI-powered financial solutions.

One key benefit is their availability. Unlike traditional advisors, they are always accessible and can quickly provide personalized suggestions. They might help users track spending, suggest ways to save, or recommend investment options tailored to individual preferences, says M.T. Ray, Managing Director of My Singapore Driver.

These tools also make managing money simpler. Instead of using complicated systems, they present tips and insights in a way that’s easy to understand. They can send notifications when spending gets high, share budgeting advice, and guide users toward better financial choices.

#6. Asset-Based Financing Growth

Asset-based financing is becoming a reliable option for businesses looking to secure funding. This type of financing allows companies to use assets like equipment, inventory, or accounts receivable as collateral for loans.

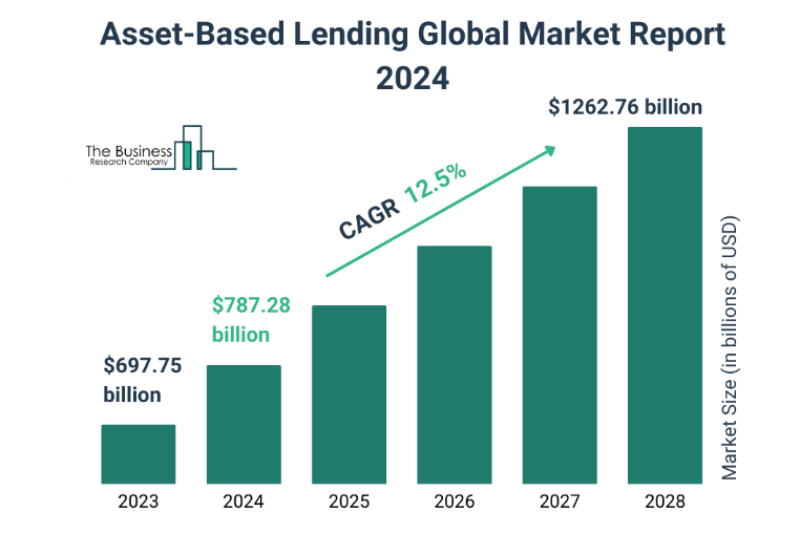

Image Source: The Business Research Company

As you can see in the above image, the global asset-based lending market is expected to grow from $697.75 billion in 2023 to $787.28 billion in 2024, with a projected CAGR of 12.5%. And it’s expected to reach $1,262.76 billion by 2028. This growth shows its rising adoption among businesses.

One reason for its appeal is its flexibility. Companies can tap into the value of their existing assets to manage daily expenses, invest in growth opportunities, or cover unexpected costs. This approach is particularly useful for businesses that may not qualify for traditional loans due to limited credit history or irregular cash flow.

Dana Ronald, President of Tax Crisis Institute says, “A key benefit is quicker access to funds. Since the loan is backed by physical assets, lenders can process approvals faster, which is crucial for businesses facing time-sensitive financial needs. This speed might provide companies with the resources they need to stay competitive.”

#7. Rise of Embedded Finance

Embedded finance is making everyday transactions simpler and more convenient. It means financial services like payments, loans, or insurance are built directly into non-financial apps or platforms we already use. Instead of switching between apps or visiting a bank, everything happens in one place — saving time and effort, says Mary, CEO of African Net Sponge.

For example, when you book a ride or shop online, you might notice options to pay, get credit, or even insure your purchase — all without leaving the app. This smooth experience is what embedded finance is all about.

It’s designed to make things easier for users by integrating financial services into the tools they already rely on.

Businesses also benefit because it helps them keep customers engaged. By offering financial services alongside their main products, they create a smoother experience that builds loyalty and boosts convenience for the user.

For consumers, this means quicker access to services without extra steps. Whether it’s splitting a bill, applying for a small loan, or buying insurance, it’s all done instantly through familiar apps.

#8. The Rise of Peer-to-Peer Lending

Peer-to-peer (P2P) lending is becoming a popular way for people to borrow and lend money without involving banks. This trend connects borrowers directly with individual lenders through online platforms, offering a fresh approach to financing, explains Nitin Motwani, Co-founder & CTO of Book My Forex.

Borrowers can secure loans at potentially lower interest rates compared to traditional bank loans, while lenders have the chance to earn better returns than what they’d typically receive from savings accounts.

One of the reasons people are turning to P2P lending is its simplicity. Borrowers can apply for loans online, often with less paperwork and fewer delays, and receive funds quickly.

On the other hand, lenders can browse through loan requests and decide who to lend to based on credit profiles, risk levels, and expected returns, giving them more control over their investments. It’s a win-win for both sides.

P2P lending is filling a gap for those who may have trouble getting loans from traditional banks due to strict requirements or credit challenges. By removing intermediaries, it offers a more personal and accessible financing option for many.

Also, it has created opportunities for small businesses, entrepreneurs, and individuals to access funds they might otherwise struggle to obtain.

#9. Buy Now, Pay Later (BNPL) Services Growing

Buy Now, Pay Later (BNPL) services are changing how people shop and pay for things. With BNPL, you can buy something right away and pay for it later in smaller, manageable installments. If you pay on time, many services, like Klarna, Afterpay, and Affirm, don’t charge interest, making it a popular option for shoppers.

According to Andrew Smith, Co-Founder of PropFusion, “For customers, BNPL makes it easier to afford bigger purchases, like a new appliance or holiday shopping, without needing a credit card. It’s simple to use, and many services send reminders to help you stay on track with payments.”

Businesses are also seeing the benefits of BNPL. By offering it at checkout, they encourage more people to complete their purchases, even for higher-priced items. This helps businesses increase sales and attract customers looking for flexible payment options.

However, use BNPL responsibly. Missing payments can lead to fees, and juggling multiple BNPL plans can cause financial stress. But for those who budget carefully, it’s a great way to spread out costs without relying on traditional loans or credit cards.

#10. Decentralized Finance (DeFi) Growth

Decentralized Finance, or DeFi, is changing the way people use financial services. Unlike traditional banking systems that rely on institutions like banks or credit unions, DeFi operates through blockchain technology. This allows users to lend, borrow, save, or trade directly with others without needing a middleman, explains Raviraj Hegde, SVP of Growth at Donorbox.

Everything is managed on decentralized platforms, which make financial services more accessible to anyone with an internet connection.

One of the biggest appeals of DeFi is the level of control it gives to users. Transactions are transparent and managed by smart contracts — self-executing agreements on the blockchain — so there’s no need for a central authority to oversee them. For example, someone can lend their cryptocurrency to others and earn interest without involving a bank. Borrowers can access funds by offering assets as collateral, often with fewer restrictions than traditional loans.

DeFi also opens up opportunities for people who may not have access to traditional financial systems, such as those without a bank account. By using decentralized platforms, they can participate in global financial markets, save money, or even invest in assets that were previously out of reach.

What sets DeFi apart is its flexibility and inclusivity. Users have full control over their funds, and the process is often quicker and less expensive than traditional financial transactions. However, DeFi comes with risks, such as price volatility and vulnerabilities in smart contracts, which users should consider carefully.

As DeFi platforms grow and new innovations emerge, they are creating a financial ecosystem where users can interact directly and independently. This shift is giving people more power over their money and redefining how financial systems work worldwide, says Eric Andrews, Owner of Mold Inspection & Testing.

Conclusion

So there you have it — 7 global financial trends to watch in 2025. These trends offer new ways to invest, save, and access services that were once complicated or out of reach.

Understanding these changes can help you make smarter decisions — whether it’s exploring new investment options, using tools to simplify budgeting, or finding faster, more flexible ways to manage finances.

The future of finance is changing quickly, and staying ready will help you make the most.

Best of luck!