After learning more about retirement planning, I appreciate gold’s investment stability. Because precious metals like gold protect against market instability and hold their value, many people are drawn to them.

An individual retirement account can hold gold and other precious metals. To diversify your retirement savings beyond paper assets, this may be important.

The pros and cons of switching from a standard IRA to a Gold IRA will be discussed as we go through the process.

To get help with changing your 401k to a gold IRA, you can download this FREE gold IRA guide. This guide tells you everything you need to know about switching your 401(k) to gold, picking the right valuable metals, and making sure you have financial security in retirement.

4 Step 401k to Gold IRA Rollover Guide

- Find a Reputable gold IRA Company

- Choose a trustworthy self directed custodian

- Open a new gold IRA account

- From your old account, transfer your funds to complete the 401k to gold ira rollover process

Top 5 Best Gold IRA Companies of 2023 At a Glance

- Augusta Precious Metals: Editor’s Choice Best Gold IRA Company Overall (4.9/5)

- American Hartford Gold: Runner up – Best Price for Bullion (4.8/5)

- Goldco: Best Gold IRA rollover & Buyback Program (4.6/5)

- Birch Gold Corporation: Great Staff Overall (4.5/5)

- Lear Capital: Top Gold IRA Firm Offering a Simplified and Easy Transaction Process (4.2/5)

#1 Augusta Precious Metals: Editor’s Choice Best Gold IRA Company Overall (4.9/5)

>>> Click here to learn more about Augusta Precious Metals <<<

Pros

- Maintain connections with their representatives.

- Lots 5-star reviews.

- A specialist can help you spread your gold and silver holdings.

- The Best of Trustlink Award has been given six times.A+BBB rating

- 2023 Money Magazine’s Pick for the Best Gold IRA Company Overall.

- It was easier to do 95% of the paperwork.

- Flexible, low-cost fee system

- No-hassle legal phone confirmation to finish the order.

- Learn Important Things.

- Absolutely No Complaints

Cons

- They are not liable for losses or damage caused by distributed denial-of-service attacks, viruses, or other harmful tech content that may affect your computer equipment, software, data, or proprietary material while using the services or downloading material from linked websites.

- Their services are US-based. Visitors outside the US must observe US and local internet content and conduct regulations. Use English for services.

Precious Metals Available

- Platinum

- Silver

- Palladium

- Gold

Minimum Investment

- $50,000

Company Background

Augusta Precious Metals: What Sets Them Apart

Established Elite Reputation

- Founded in 2012

- Thousands of five-star reviews

- Numerous prestigious awards

Three Commitments

- Transparency: Prioritizing integrity to differentiate from competitors

- Simplicity: Preselected products, simplified buying, and paperwork support

- Service: Expert knowledge sharing, customized options, and exceptional customer service

Educational Focus

- Led by an in-house Harvard-trained economic analyst

- Educates investors on diversifying savings with an Augusta Precious Metals IRA

Dedicated Team of Professionals

- Available throughout your account lifetime

- Expertise and tools for diversifying savings with a precious metals IRA

Mission Statement

Empowering Americans to diversify retirement savings and prepare for the future through education.

Joe Montana’s Insights on Augusta Precious Metals

- Impressed by their extensive knowledge of gold, silver, and the economy

- Offers valuable education and resources

- Team-oriented approach for smooth transactions

- Maintains transparency even post-purchase

Consider Augusta Precious Metals and explore the world of precious metals for your financial future. For in-depth knowledge, inquire about a one-on-one conference with their education team led by Devlyn Steele.

>>> Click here to learn more about Augusta Precious Metals <<<

#2. American Hartford Gold: Runner up – Best Price for Bullion (4.8/5)

>>> Click here to learn more about American Hartford Gold <<<

Pros

- Dedicated client service with a personal touch.

- Experienced staff to provide direction.

- Customer education and support is a priority.

- Hassle-free policies, reasonable costs, and strong security.

- Bonus coins, price matching guarantee, and free IRA setup/storage are all available.

- No first-year trade fees, and qualified orders receive free shipping.

- 5000 ranked us as the #1 gold company.

- Rollover retirement funds into a precious metals IRA.

- Gold, silver, platinum, and palladium are the precious metal IRA possibilities.

- Easy IRA establishment or actual asset purchase.

- Trustpilot top-rated, with an A+ BBB rating.

Cons

- The latest pricing should be added on the webpage.

Precious Metals Available

- Platinum

- Silver

- Palladium

- Gold

Minimum Investment

- $10,000

Company Background

American Hartford Gold is a top-tier gold IRA company founded in 2015, specializing in providing reliable financial advice on precious metals.

They help individuals and families invest in Gold, Silver, and Platinum, whether for personal ownership or within retirement accounts like IRAs, 401Ks, or TSPs.

Their focus is on portfolio security, offering high-quality coins at competitive prices, all backed by a 100% customer satisfaction guarantee.

The company’s leadership is dedicated to providing quality service and fair pricing, offering timely market insights that combine contemporary data with historical context to empower investors.

American Hartford Gold maintains an A+ rating with the Better Business Bureau and boasts 5-star customer satisfaction ratings on platforms like Trustpilot and Google.

It ranks among America’s fastest-growing private companies on the Inc. 5000 list and has earned endorsements from trusted figures such as Bill O’Reilly, Rick Harrison, and Lou Dobbs, gaining the trust of both its endorsers and audience.

American Hartford Gold’s Commitment to You:

- Dedicated customer service

- Transparent and clear pricing

- Extensive market knowledge

- Strong commitment to buybacks

- Exceptional quality in shipping and handling

- Timely and informative updates

- Privacy assurance

- Commitment to providing clarity

>>> Click here to learn more about American Hartford Gold <<<

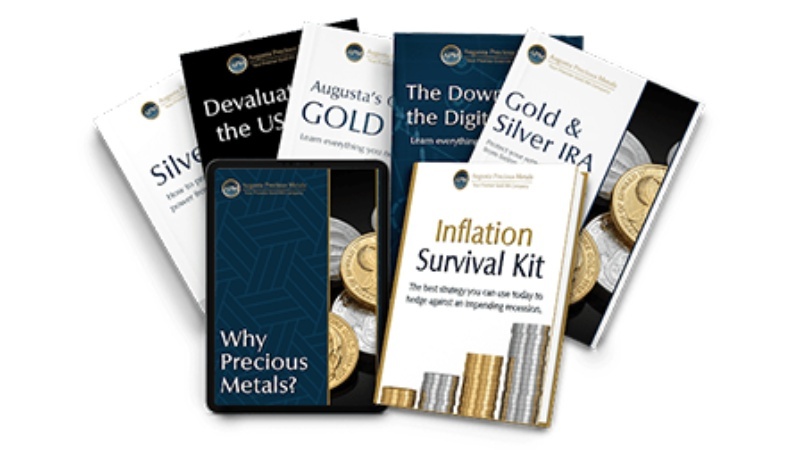

#3 Goldco: Best Gold IRA rollover & Buyback Program (4.6/5)

>>> Click here to learn more about Goldco <<<

What We Love About Goldco:

- Easy account setup with minimal paperwork.

- Over 4,400 consumers have given them five-star ratings.

- They’ve sold nearly a billion dollars in precious metals to satisfied customers.

- Qualify for up to $10,000 in free silver when you open an account today.

- Backed by the finest money-back guarantee.

- Explore a fantastic selection of gold bars and coins.

- Get help with your gold IRA rollover.

- Endorsed by Chuck Norris, Sean Hannity, and Ben Stein.

Precious Metals Available

- Gold

- Silver

- Palladium

- Platinum

Minimum Investment

- $25,000

Company Background

Goldco, based in Los Angeles with over a decade of experience, is your trusted partner for safeguarding retirement savings. They specialize in Precious Metals IRAs and direct gold and silver purchases, helping diversify retirement funds with simplicity.

Goldco is known for ethical practices, exceptional customer service, and valuable educational resources, making it the ideal choice for those prioritizing their financial future. Prominent figures like Sean Hannity, Chuck Norris, Ben Stein, and Stew Peters endorse Goldco, highlighting their commitment to excellence.

As a standout player in the precious metals industry, Goldco offers retirement savings protection in IRAs, 401(k)s, 403(b)s, TSPs, and other tax-advantaged accounts. Their knowledgeable Goldco Specialists excel in managing Precious Metals IRAs and their benefits.

Besides Precious Metals IRAs, Goldco facilitates direct gold and silver purchases to diversify investments, guiding you through the process, whether you’re rolling over retirement funds or buying precious metals directly.

Goldco holds an A+ BBB rating and a Triple-A grade from the Business Consumer Alliance, reflecting their dedication to customer service, reliability, and ethical business practices.

Join the ranks of over 5,000 satisfied customers who have awarded Goldco a five-star rating.

>>> Click here to learn more about Goldco <<<

#4 Birch Gold Corporation: Great Staff Overall (4.5/5)

>>> Click here to learn more about Birch Gold <<<

Pros

- Receive a Free Information Kit.

- Minimum purchase amount is $10,000.

- Convenient payment options via wire or personal check.

- Shipment protection against loss or damage.

- Access to specialists for answering questions.

- High ratings, including A+ from BBB, AAA from BCA, 5-star ratings on Consumer Affairs, and GoldDealerReviews.com.

Cons

- The website should provide more transparency about fees.

- Limited to domestic operations; no international services available.

Precious Metals Available

- Platinum

- Silver

- Palladium

- Gold

Minimum Investment

- $10,000

Company Background

Birch Gold Group has been a leading dealer of physical precious metals in the United States since 2003, proudly serving clients in all 50 states.

They are frequently featured on major news and media platforms, including the Ben Shapiro Show and War Room with Steve Bannon, where they discuss factors influencing market stability and growth cycles.

Their dedicated team of professionals brings decades of collective experience, having previously worked at esteemed companies such as Citigroup, Dun & Bradstreet, and IBM. Leveraging this expertise and their commitment to customer satisfaction, they ensure a seamless and straightforward process for your purchases or IRA setup.

The team prioritizes swift responses to your inquiries, emphasizing your comfort and understanding of the process. They aim to provide you with all the necessary information for effective retirement planning.

Birch Gold Group’s Customer Relations Department ensures the complete satisfaction of every customer through diligent follow-up. On their customer reviews page, you can access authentic feedback from past clients.

Over nearly two decades, Birch Gold Group has established an outstanding reputation in their field, evident through numerous awards and positive reviews from independent business review organizations. You can trust Birch Gold Group to assist you in shaping your financial future.

Why Birch Gold Group?

Their core values include:

- Knowledge

- Personalized care

- Trust

Their stringent standards encompass:

- Customer empowerment

- Education

- Empathy

- Ethics

- Transparency

- Efficiency

Birch Gold Group empowers their customers through education, sharing their objectives, motivations, and concerns. Obtaining information about precious metals and their company is readily accessible. They ensure you comprehend the best options and the pros and cons of each, enabling you to make informed decisions with confidence. You’ll feel confident in your choices knowing this.

>>> Click here to learn more about Birch Gold <<<

#5. Lear Capital: Top Gold IRA Firm Offering a Simplified and Easy Transaction Process (4.2/5)

>>> Click here to learn more about Lear Capital <<<

Pros

- Enjoy a 24-Hour Risk-Free Purchase Guarantee.

- Benefit from Fast Shipping Direct to Your Home.

- Get Free IRA Setup and Storage.

- Impressive 4.9 Rating on Trustpilot.

- Receive Your Free Investor Kit.

- Access Free Gold & Silver Guides.

- Count on a Price Match Guarantee.

- Stay updated with Real-Time Metals Pricing.

- Receive a Free Evaluation on Metals from Others.

Cons

- Self-directed IRAs come with a nominal annual fee.

- A minimum purchase requirement is in place.

Precious Metals Available

- Palladium

- Silver

- Platinum

- Gold

Minimum Investment

- $25,000

Company Background

Lear Capital has been dedicated to ensuring your long-term financial security since 1997 when they established themselves as a leader in America’s precious metals industry. They are committed to earning and maintaining your business by providing exceptional service. Whether you’re looking to diversify your portfolio with bullion, high-quality rare coins, or authentic gold and silver for an IRA, Lear Capital has a strategy tailored to your needs. Whether you want to adjust your asset allocation, safeguard against global market volatility, or plan for retirement, they’ve got you covered.

Lear Capital understands the various investment options available in the rare metal market and streamlines the buying process for you, making transactions quick and easy. They offer a personal account manager, secure order placement, and provide real-time updates on spot prices, precious metal news, and economic events that could impact your retirement and future.

Lear Capital takes pride in their AAA Business Consumer Alliance rating and is recognized as a PCGS Authorized Dealer, ensuring accurate coin grading. They adhere to the coin grading criteria established by the Numismatic Guaranty Corporation (NGC) and align with the Industry Council for Tangible Assets (ICTA) on matters related to taxation, IRS rules, and tangible asset laws.

>>> Click here to learn more about Lear Capital <<<

What Is a Gold IRA?

According to history, buyers have turned to gold when the economy was unstable. Another good way to invest in a Gold IRA is in gold-backed ETFs, gold coins and bars, or gold certificates of deposit. Understanding the different ways to invest in gold and how the shift will affect your taxes is very important because the process is so complicated.

A Gold IRA rollover guide can help investors learn more about the benefits of investing in gold, such as how it can protect against inflation, offer possible tax benefits, and provide long-term capital growth.

Why Choose a Gold IRA?

The moment I began to assess the performance of my retirement portfolio, particularly during periods of stock market tumult, I became acutely aware of the need for an alternative that could stand firm. My research led me to the Gold IRA as a bulwark against the tempestuous nature of market volatility, offering a degree of safety not typically found in traditional retirement accounts.

I’ve observed with keen interest how gold investments carve a niche for themselves, remaining largely unfazed by the fluctuations that can affect paper assets. This attribute of gold catapulted it to the top of my list of investment options, promising a serene consistency for my retirement savings account amid economic unpredictability.

As I delved deeper, the tax benefits associated with certain types of Gold IRAs, such as a Roth IRA, emerged as a compelling argument to convert IRA to gold. The potential for tax-free growth and withdrawals puts a spotlight on the strategic advantage of including a precious metal component in a retirement plan. It’s a smart financial move that aligns with my long-term retirement savings strategy.

Another persuasive factor in my decision to convert IRA into gold was the customer service and support from prominent IRA companies. Providers such as Goldco and Birch Gold Group offer seasoned guidance on the rollover process and investment strategy, ensuring every step of my retirement plan conversion is meticulously addressed, from selecting the right precious metal to coordinating with the account custodian.

Setting Up Your Gold IRA Account

The decision to set up my Gold IRA account was clear-cut, but navigating the initiation process required some focus. I sought out an IRA company with a strong customer service reputation that could fully assist me. After some consideration and reviewing opinions on various platforms like Investopedia, I chose a firm renowned for its expertise in precious metals IRAs.

Next, I had to choose between a rollover or a direct transfer. A rollover would mean moving funds from a retirement account to a gold IRA, usually within a 60-day window to avoid penalties. On the other hand, a direct transfer ira to gold would involve my retirement funds moving seamlessly from another IRA account directly to the new Gold IRA, bypassing any potential for a taxable event.

- Research and select a reputable IRA company specializing in precious metals.

- Decide on a rollover or direct transfer to move retirement funds into the Gold IRA.

- Communicate with the chosen company to initiate the transfer process.

- Ensure compliance with IRS rules and regulations throughout the process.

After initiating the transfer process, communication became a linchpin: I engaged with my new account custodian to ensure all paperwork was in order. They guided me, highlighting important considerations like contribution limits and potential tax implications, ensuring full compliance with IRS rules and regulations.

The final step was to select the physical gold products to hold in my IRA. I contemplated various forms, from gold coins to bullion bars, meticulously reviewing their purity level and authenticity, critical factors that gold IRA custodians rigorously check. Decisions were made, forms were signed, and soon enough, my retirement funds were securely vested in gold investments within a storage facility’s fortified walls.

Two Ways to Move Funds from Your Existing IRA to a Gold IRA

Embarking on the journey to convert IRA to gold, I was faced with the pivotal decision of how to move my hard-earned retirement savings into this resilient asset class.

This decision was not taken lightly, knowing that the chosen method could influence my financial landscape for years to come.

I honed in on two distinct avenues: a Gold IRA rollover and a direct gold IRA transfer.

Both paths, though leading to the same destination—a fortified retirement investment in gold—present unique procedures and benefits that demanded thorough examination.

Transfer Funds from an IRA to Gold IRA

Exploring the direct transfer method to shift funds into a precious metals IRA opened my eyes to its straightforward nature. The funds travel from one IRA custodian to another without the money ever passing through my hands: this ensures the process is not classified as a taxable distribution.

- Engage with the current IRA custodian to initiate the transfer request.

- Select a trustworthy precious metals IRA company to receive the funds.

- Coordinate between both custodians to process the transfer smoothly.

- Review the transaction to ensure the funds have been properly transferred to the Gold IRA.

This smooth transition, without the worry of tax events or timing constraints, provides the assurance that my retirement funds are transitioning efficiently. The process encapsulates both ease and compliance, key factors in handling retirement investments responsibly.

Gold IRA Rollover

When I embarked on a Gold IRA rollover, I was taking the bold step of transitioning assets from my existing retirement account into a precious metals IRA. This maneuver involved receiving a distribution from my current retirement account and then depositing those funds into my gold IRA within an allocated 60-day period, thereby avoiding any tax penalties.

By choosing the rollover approach, I had the flexiblity to take control of the process, actively managing the funds’ movement. My attention to detail and timing was critical; a slip beyond the 60-day window could lead to unwelcome tax implications, but I navigated it decisively, securing my retirement funds amidst the sheen of gold assets.

Why Choose a Transfer Over a Gold IRA Rollover?

In my quest to solidify my retirement plan with the luster of gold, weighing the options between initiating a gold IRA rollover and opting for a direct transfer was imperative.

Both methods offer unique benefits and potential drawbacks, which necessitated a deep exploration to align with my financial objectives.

The decision rested upon the fine balance between ease of transition, tax efficiency, and maintaining continuity in the growth of my nest egg.

Here, I shall unfold the pros and cons of each approach, as understanding them proved critical in making the most informed choice for my retirement investment strategy.

The Pros and Cons of a Gold IRA Rollover

The allure of a Gold IRA rollover lies in the control it offers: it permits me to handle the funds directly, even if just for a limited timeframe. This hands-on approach can be empowering, providing a clear view of the transition every step of the way.

Nevertheless, the rollover method comes with its share of cautions, demanding an acute awareness of the timing involved to avoid tax penalties. This window of opportunity is narrow – missing the 60-day mark could result in significant financial consequences:

- Direct handling of funds offers transparency and personal management during transition.

- There’s a stringent 60-day period for redepositing funds into the Gold IRA to circumvent tax repercussions.

- Meticulous oversight is necessary to avert any potential tax liabilities.

The Pros and Cons of a Transfer

Choosing the transfer method placed convenience at the forefront of my retirement plan transition. A transfer eliminated concerns about personal management of funds within a limited timeframe, a relief given the potential for costly mistakes.

- Transfers are managed directly between custodians which circumvents the risk of incurring a taxable distribution.

- The absence of a 60-day period offers a stress-free approach without fear of tax penalties for missing a deadline.

- Overall, transfers present a seamless transition, preserving peace of mind and the continuity of my retirement investment’s growth.

However, with every advantage comes potential downsides; despite a transfer being less hands-on, it requires trust in custodians to handle the process efficiently. It’s essential to work with reputable IRA companies to mitigate the risks of coordination errors that could affect my gold investment’s security.

Step-by-step Guide on How to Transfer Your IRA to a Gold IRA

Embarking on the transition within the realm of retirement investment, specifically to convert IRA to gold, is akin to setting forth on a path less traveled, yet abundant with potential rewards.

It is a journey that requires clear steps, each carefully planned and executed—one that echoes the meticulous craftsmanship of the precious metals themselves.

My quest began with a quest for a reputable Gold IRA company, followed by forging a partnership with my current IRA custodian.

Together, we navigate the transfer of funds, the selection of worthy physical precious metals, and ensure the securement of this wealth within a fortified vault.

Each step of the process is deliberate, inviting reflection and foresight as I continually monitor the progress of my account towards a promised land of financial security.

1. Find a Reputable Gold IRA Company

Embarking on the journey to fortify my retirement savings, the pivotal first step was to partner with a Gold IRA company that had a solid reputation for trustworthiness and expertise. I sifted through customer reviews, checked ratings, and compared track records, knowing the company I chose would become the steward of my financial future.

Among the names that surfaced, Goldco, Augusta Precious Metals, and American Hartford Gold stood out; they not only had the expertise in converting IRAs into gold but also demonstrated exceptional customer service and transparent business practices. My choice hinged on finding a partner that could provide a seamless transfer with a deep understanding of precious metal investments and the retirement landscape.

2. Get in Touch with Your Current IRA Custodian

Once I had settled on a trustworthy Gold IRA company, my next course of action involved reaching out to my current IRA custodian. This was an essential conversation, one where I would convey my intent to transfer funds, seeking their cooperation and understanding of my new financial direction.

My IRA custodian and I discussed the details pertinent to the transfer, ensuring there were no gaps or oversights that could hinder the process. It was my responsibility to express clearly my goals, and likewise, their duty to guide me through the procedural aspects that would facilitate a smooth transition of my retirement funds to a Gold IRA.

3. Your Custodian Will Complete the Transfer

Once the decision for a transfer is made and communicated, my IRA custodian sets the wheels in motion. Their expertise becomes the backbone of the process, competently coordinating with the Gold IRA company to ensure the funds are correctly transferred.

Transparency is key during this stage: I receive regular updates and confirmations throughout the transaction. My custodian oversees the smooth sailing of my retirement funds into the safe harbor of a precious metals IRA:

- Initiate transfer request and authorize the move of funds to the Gold IRA company.

- Complete required documentation to facilitate the transfer process.

- Confirm successful transfer of funds to the new Gold IRA account.

4. Purchase Physical Precious Metals

With the transfer to my Gold IRA successfully underway, the selection of physical precious metals became my next focal point. I meticulously evaluated options, consulting with my IRA company on gold coins and bullion bars that met the purity and weight requirements, essential for inclusion in my account.

- Review the IRA company’s selection of gold investment products, ensuring compliance with IRS standards.

- Consider the variety of available gold products, from coins to bullion, based on personal investment strategy.

- Consult closely with the investment advisor from the IRA company to make informed decisions regarding the physical precious metals to add to my retirement portfolio.

Decision-making about which precious metals to add was a critical juncture: I aimed to balance my portfolio with a mix of gold investments. I stayed abreast of current gold prices, aiming to maximize the potential of my retirement fund, cognizant that this was more than a purchase—it was a safeguard for my future.

5. Your Physical Gold Will Be Moved to a Secure Facility

With my gold investment decisions settled, attention turned to the secure storage of my assets. A storage facility with a robust security system is where my chosen gold IRA company would transfer the physical metals. This depository not only provides a secure environment against theft or damage but also ensures my gold investments are held in a location approved by the Internal Revenue Service.

The gold IRA provider facilitates the relocation of my selected precious metals to the designated depository. They coordinate the logistics, guaranteeing a seamless transfer from the point of purchase to the storage facility. This meticulous process is invisible to me but remains crucial in securing the physical representation of my retirement funds:

- Establish a secure location for the stored physical gold, in compliance with IRS specifications.

- Trust the gold IRA provider to manage the transport and delivery to the security facility.

- Receive confirmation of the precious metals’ arrival and secure storage.

6. Keep Track of Your Account

Once the physical gold is secured in the depository, continual monitoring of my Gold IRA is pivotal. It’s essential to engage with the chosen IRA company and ensure they provide regular account statements, either electronically through my email address or via mailed reports, to keep me informed about my precious metals investments and any shifts in market conditions.

Staying proactive with my gold investments means regularly consulting with my investment advisor to evaluate my retirement strategy. This oversight ensures my golden nest egg keeps pace with my financial goals, adapting to changes in legislation, contribution limits, or alterations in the market landscape:

- Secure regular updates on account performance and gold price trends.

- Consult periodically with the investment advisor to fine-tune retirement strategy.

- Maintain vigilance over the retirement funds to ensure continual growth and security.

The Costs Associated with Transferring Funds to a New Gold IRA

When I resolved to convert my IRA to gold, I knew that understanding the associated costs of transferring my retirement funds was as vital as the decision itself. There’s a financial commitment in setting up a precious metals IRA, which includes various fees such as setup charges, annual maintenance, and storage fees. My priority was to ensure that these expenses were transparent and justified in relation to the long-term benefits of gold investing.

Storage fee was the first cost I encountered, as secure storage is non-negotiable for physical gold within an IRA. I chose a depository that not only provided a fortress for my assets but would also fit within my retirement savings strategy. Fees charged by a depository can vary based on the type of storage—commingled or segregated—and I opted for a plan that balanced cost with the safety of my investment.

Next in line were the setup fees and annual maintenance costs, levied by the IRA company for their services. These costs, while initially seemed like a dent in my funds, were an investment towards ensuring my account’s regulatory compliance and effective management. I took comfort in the fact that these charges would help to maintain the integrity and growth of my retirement portfolio over time.

Lastly, I focused on the potential transaction fees that might arise when buying or selling the gold. My discussions with investment advisors from reputable companies like Rosland Capital and Birch Gold Group emphasized the significance of low transaction fees to maximize my precious metal’s investment potency. Diligent research and a keen eye on the fee structure became instrumental to my strategy of fortifying my nest egg against future market uncertainty.

Rolling Over a 401K to a Gold IRA

Transitioning from a traditional 401K to a Gold IRA presented an exciting new chapter in my retirement planning journey.

Confronted with the task of safeguarding my future against economic fluctuation, I was compelled to consider a more tangible form of security.

My first order of business was to align myself with a Gold IRA company that reflected my values and vision for stability and growth.

As I prepared for this pivotal rollover, my focus was to ensure that every move—from selecting the firm best suited to handle my needs to the crucial act of rolling over funds, followed by the deliberate purchase of physical gold or other precious metals—was executed with precision.

Each step was to serve as a steadfast brick in the foundation of my retirement security, creating a bulwark against uncertainty.

1. Decide Which Gold IRA Company to Work with

Choosing the right Gold IRA company is the cornerstone of transitioning my 401K into a precious metals IRA and therefore warrants a methodical approach. I evaluate each candidate’s track record, focusing on their expertise, adherence to compliance, and the robustness of their security measures, especially regarding the storage facility. Trust is hard-earned, and I seek an IRA company like Goldco or Augusta Precious Metals, which is known to vigilantly oversee the entire rollover process while offering insightful investment advice.

In determining the best Gold IRA company to partner with, customer service reigns supreme. I examine reviews, seeking out firms commended for exceptional service, like American Hartford Gold and Birch Gold Group, because I appreciate a responsive team that is both knowledgeable and attentive to my needs throughout the rollover journey. These interactions provide the assurance needed to entrust the company with my retirement savings as I step into the realm of gold investing.

2. Roll Over Your Funds

Rolling my funds over into a Gold IRA meant initiating a direct movement of my existing 401K into a new, precious metals-oriented retirement account. It was crucial to act within the established 60-day rollover window to prevent potential tax penalties and ensure a tax-deferred status of the transferred funds.

Coordination between my current retirement account custodian and my chosen Gold IRA company facilitated the rollover process. I took charge to ensure every step was precise and timely:

- Contact the 401K plan administrator to request a rollover to a Gold IRA.

- Choose whether to conduct a direct rollover or to receive and deposit the funds personally within the 60-day period.

- Provide the new Gold IRA account details to the 401K administrator for the transfer.

- Confirm the funds have rolled over into the Gold IRA without incurring taxes or penalties.

3. Purchase Physical Gold, Silver, Palladium, or Platinum

With the successful rollover of my 401K into a Gold IRA, attention turned to the core of the matter: selecting the physical precious metals to enrich my retirement account. The choice spanned beyond just gold, as options like silver, palladium, and platinum presented themselves, each with their own merits and compliant with stringent IRS standards for purity.

- Organize consultations with the investment advisor to understand the market dynamics and the benefits of diversifying my holdings.

- Scrutinize each metal’s historical performance, current market trends, and long-term forecasts.

- Make a well-informed decision that aligns with my investment goals and the risk profile I am comfortable with.

The final purchase was not an impulsive leap but rather the result of meticulous planning and strategy: a balanced blend of gold, silver, palladium, and platinum. Each metal was chosen for its potential to fortify my retirement savings against the fickle nature of traditional markets, safeguarding my financial future with tangible assets.

Finding the Right Gold IRA Company to Help with Your New Gold IRA Account

Embarking on the path to a gold-infused future begins with finding the right Gold IRA company, one poised to expertly guide the transition of your retirement funds. This firm should not only boast a history of reliability and success in the sphere of precious metals but also reflect a commitment to personalized investor care. Selecting this partner is a critical step: a sterling ally is crucial for peace of mind and the successful fruition of your investment aims.

A Gold IRA company must also align with your particular financial objectives and investment strategy: two key elements that will shape the future of your retirement portfolio. Whether it be the quest for a stable retirement savings account amidst a turbulent economy or the strategic diversification of assets, the firm’s vision must mirror your own. Identifying such an entity demands diligence, and the resonance between the investor’s ethos and the company’s modus operandi will be telling.

The process unfolds through a series of decisive actions that are punctuated by clarity and forward momentum: research, engagement, and selection, each vital for navigating this new investment terrain. An ideal partner not only understands the ins and outs of gold investing, but also adeptly handles the complexities of IRA accounts and the specifics of IRS regulations:

- Commence with comprehensive research to identify reputable Gold IRA companies.

- Engage with potential firms to discuss your retirement goals and evaluate their offerings.

- Decide on a company that provides robust customer service, a competitive fee structure, and a proven track record in managing Gold IRA rollovers and transfers.

When I reach the juncture of decision-making, factors like customer service, fee transparency, and regulatory wisdom stand at the forefront. The chosen company, after all, will be the custodian of my retirement funds, responsible for translating my golden vision into tangible assets, securely stored and thoughtfully managed. Thus, the importance of opting for a firm with an exceptional customer service record, like Augusta Precious Metals or American Hartford Gold, resonates deeply with my intent to safeguard my future investment.

Final Thought- Convert IRA to Gold

Changing an IRA to gold is a smart way to manage your money if you want to be safe and stable during economic downturns.

By doing this, investors protect some of their retirement savings in real gold, using its long history of strength and value to protect against inflation and market instability.

>>> Click here to learn more about Augusta Precious Metals <<<

Picking a trustworthy Gold IRA company is important for a smooth transition because it will help with the rollover or transfer process, make sure you follow IRS rules, and give you expert advice on which valuable metals to buy.

A gold IRA gives you real protection and the chance to grow your money without paying taxes on it. It’s a great addition to a well-rounded retirement portfolio.

This is a smart move that will not only help retirees store their wealth but also give them long-term buying power.

Published By: Zeest Media