Disclosure: We are reader-supported. If you buy through links in our post, we may earn a commission. This is not financial advice. Please consult with your financial advisor.

Considering a 401k to gold IRA rollover? You’re not alone. Many are diversifying their retirement portfolios by shifting traditional 401k funds into gold IRAs. This adds physical gold and precious metals to your retirement savings, safeguarding against inflation and market volatility.

In this article, we’ll explore the benefits, process, and key points for a 401k to gold IRA rollover. Whether you’re an experienced investor or new to retirement planning, understanding this conversion is invaluable.

>>>click here for Top Gold IRA Rollover Companies<<

401K to Gold IRA Rollover 2024 Reviews

Considering a 401(k) to gold IRA transfer? Get our FREE gold IRA guide for key details on converting your 401(k) to gold investments, choosing the right precious metals, and securing your retirement finances.

4 Step 401k to Gold IRA Rollover Guide

- Find a Reputable gold IRA Company

- Choose a trustworthy self directed custodian

- Open a new gold IRA account

- From your old account, transfer your funds to complete the 401k to gold ira rollover process

Converting your IRA into gold, called a Gold IRA rollover, is a straightforward process. It starts with setting up a self-directed IRA, followed by transferring funds from your existing IRA. Then, you’ll acquire physical precious metals. This method allows you to diversify your retirement investments with the stability of gold.

Here’s a quick glance at the Top 5 Gold IRA Companies in 2024:

- Augusta Precious Metals: Editor’s Choice Best Gold IRA Company Overall (4.9/5)

- American Hartford Gold: Runner up . Best Price for Bullion (4.8/5)

- Goldco: Best Gold IRA rollover & Buyback Program (4.6/5)

- Birch Gold Group: Great Staff Overall (4.5/5)

- Lear Capital: Top Gold IRA Firm Offering a Simplified and Easy Transaction Process (4.2/5)

#1 Augusta Precious Metals: Editor’s Choice Best Gold IRA Company Overall (4.9/5)

>>>Click Here for Free Gold IRA Kit Augusta Precious Metals<<<

Pros:

- Stay connected with dedicated representatives.

- Numerous 5.star reviews show high customer satisfaction.

- Access specialists for diversifying gold and silver holdings.

- time Best of Trustlink Award winner with an A+ BBB rating.

- Named 2023 Money Magazine’s top pick for Best Gold IRA Company Overall.

- Simplified paperwork, covering 95% of requirements.

- Flexible and cost.effective fee system.

- Streamlined legal phone confirmation for easy order completion.

- Gain valuable financial insights.

- Remarkably low complaint record.

Cons:

- Primarily serves the United States.

Precious Metals Available:

- Platinum

- Silver

- Palladium

- Gold

Minimum Investment:

. $50,000

Company Background:

Augusta Precious Metals . What Sets Them Apart

- Established in 2012 with an excellent reputation.

- Thousands of five.star reviews and numerous prestigious awards.

Three Commitments:

- Transparency: Their commitment to integrity distinguishes them.

- Simplicity: They offer pre selected products, simplified purchasing, and comprehensive paperwork support.

- Service: Providing expert knowledge, tailored options, and exceptional customer support.

Educational Focus:

Led by an in.house economic analyst trained at Harvard, Augusta Precious Metals educates investors on diversifying savings through a Precious Metals IRA.

Dedicated Team of Professionals:

Their team is available throughout your account’s lifetime, offering expertise and tools for diversifying savings through precious metals.

Mission Statement:

Augusta Precious Metals is dedicated to empowering Americans to diversify retirement savings and prepare for the future through education.

Joe Montana’s Insights on Augusta Precious Metals:

- Joe Montana is impressed by their extensive knowledge of gold, silver, and the economy.

- They offer valuable education and resources.

- Their team.oriented approach ensures smooth transactions.

- Augusta Precious Metals maintains transparency even after a purchase.

Consider Augusta Precious Metals as your gateway to the world of precious metals for your financial future. For in.depth knowledge, inquire about a one.on.one conference with their education team led by Devlyn Steele.

>>>Click Here for Free Gold IRA Kit Augusta Precious Metals<<<

#2. American Hartford Gold: Runner up . Best Price for Bullion (4.8/5)

>>>Click Here for Free Gold IRA Kit American Hartford Gold<<<

Pros:

- Dedicated client service with a personal touch.

- Experienced staff for expert guidance.

- Top priority on customer education and support.

- free policies, reasonable costs, and strong security.

- Bonus coins, price matching guarantee, and free IRA setup and storage.

- No first.year trade fees, with qualified orders receiving free shipping.

- Ranked #1 gold company on Inc. 5000.

- Easy rollover of retirement funds into a precious metals IRA.

- Wide range of precious metals for your IRA: gold, silver, platinum, palladium.

- Simple asset purchases.

- rated on Trustpilot with an A+ BBB rating.

Cons:

- Need to update pricing information on our webpage.

Precious Metals Available:

- Platinum

- Silver

- Palladium

- Gold

Minimum Investment:

$10,000

Company Background:

American Hartford Gold, founded in 2015, is a top.tier gold IRA company specializing in providing reliable financial advice on precious metals. They assist individuals and families in investing in Gold, Silver, and Platinum, whether for personal ownership or within retirement accounts like IRAs, 401Ks, or TSPs.

Their primary focus is on portfolio security, offering high.quality coins at competitive prices, all backed by a 100% customer satisfaction guarantee. The leadership team is dedicated to providing quality service and fair pricing, offering timely market insights that combine contemporary data with historical context to empower investors.

American Hartford Gold maintains an A+ rating with the Better Business Bureau and boasts 5.star customer satisfaction ratings on platforms like Trustpilot and Google. They rank among America’s fastest.growing private companies on the Inc. 5000 list and have earned endorsements from trusted figures such as Bill O’Reilly, Rick Harrison, and Lou Dobbs, gaining the trust of both endorsers and their audience.

Their Commitment to You:

- Dedicated customer service

- Transparent and clear pricing

- Extensive market knowledge

- Strong commitment to buybacks

- Exceptional quality in shipping and handling

- Timely and informative updates

- Privacy assurance

- Commitment to providing clarity

Invest with American Hartford Gold and benefit from their dedicated and knowledgeable team.

>>>Click Here for Free Gold IRA Kit American Hartford Gold<<<

#3 Goldco: Best Gold IRA rollover & Buyback Program (4.6/5)

>>>Click Here for Free Gold IRA Kit Goldco<<<

What We Love About Goldco:

- Quick and easy account setup with minimal paperwork.

- Stellar reputation with 4,400+ five.star ratings.

- Sold nearly a billion dollars in precious metals.

- Qualify for up to $10,000 in free silver when opening an account today.

- Strong money.back guarantee.

- Impressive selection of gold bars and coins.

- Expert assistance for your gold IRA rollover.

- Endorsed by Chuck Norris, Sean Hannity, and Ben Stein.

Precious Metals Available:

- Gold

- Silver

- Palladium

- Platinum

Minimum Investment:

. $25,000

Company Background:

Goldco, headquartered in Los Angeles with over a decade of experience, is your trusted partner for safeguarding retirement savings. They specialize in Precious Metals IRAs and direct gold and silver purchases, simplifying the diversification of your retirement funds.

Goldco is known for ethical practices, exceptional customer service, and valuable educational resources, making it the ideal choice for those prioritizing their financial future. Prominent figures like Sean Hannity, Chuck Norris, Ben Stein, and Stew Peters endorse Goldco, highlighting their commitment to excellence.

As a standout player in the precious metals industry, Goldco offers retirement savings protection in IRAs, 401(k)s, 403(b)s, TSPs, and other tax.advantaged accounts. Their knowledgeable Goldco Specialists excel in managing Precious Metals IRAs and their associated benefits.

In addition to Precious Metals IRAs, Goldco also facilitates direct gold and silver purchases to help diversify your investments, guiding you through the process, whether you’re rolling over retirement funds or purchasing precious metals directly.

Goldco proudly holds an A+ BBB rating and a Triple.A grade from the Business Consumer Alliance, reflecting their unwavering dedication to customer service, reliability, and ethical business practices.

Join over 5,000 satisfied customers who have awarded Goldco a five.star rating, and let them help you secure your financial future.

>>>Click Here for Free Gold IRA Kit Goldco<<<

#4 Birch Gold Group: Great Staff Overall (4.5/5)

>>>Click Here for Free Gold IRA Kit Birch Gold<<<

Pros:

- Get a Free Information Kit.

- Minimum purchase starts at $10,000.

- Convenient payment options via wire or personal check.

- Shipment protection against loss or damage.

- Access to experts for your questions.

- High ratings, including A+ from BBB, AAA from BCA, 5-star ratings on Consumer Affairs, and GoldDealerReviews.com.

Cons:

- Website needs more fee transparency.

- Limited to domestic operations; no international services offered.

Available Precious Metals:

- Platinum

- Silver

- Palladium

- Gold

Minimum Investment:

$10,000

Company Background:

Birch Gold Group, a leading physical precious metals dealer in the United States since 2003, serves clients in all 50 states. They are featured on major news and media platforms like the Ben Shapiro Show and War Room with Steve Bannon, discussing market stability and growth factors. Their experienced team, formerly from Citigroup, Dun & Bradstreet, and IBM, ensures a seamless process for purchases and IRA setup.

With quick responses to inquiries, Birch Gold Group prioritizes your understanding of the process, aiding in effective retirement planning. Their Customer Relations Department guarantees satisfaction through diligent follow-up and authentic client feedback.

Over nearly two decades, Birch Gold Group has gained an outstanding reputation with numerous awards and positive reviews. Trust them to shape your financial future.

Why Birch Gold Group?

- Core values: Knowledge, Personalized care, Trust

- Stringent standards: Customer empowerment, Education, Empathy, Ethics, Transparency, Efficiency

Birch Gold Group empowers customers through education, ensuring you understand the best options and their pros and cons. You can make informed decisions with confidence, knowing they have your back.

>>>Click Here for Free Gold IRA Kit Birch Gold<<<

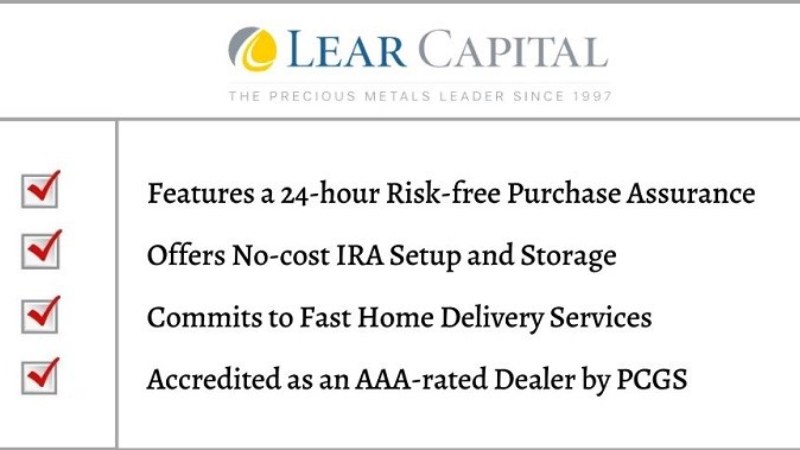

#5. Lear Capital: Top Gold IRA Firm Offering a Simplified and Easy Transaction Process (4.2/5)

>>>Click Here for Free Gold IRA Kit Lear Capital<<<

Pros:

- Enjoy a 24.Hour Risk.Free Purchase Guarantee.

- Benefit from Fast Shipping Direct to Your Home.

- Get Free IRA Setup and Storage.

- Impressive 4.9 Rating on Trustpilot.

- Receive Your Free Investor Kit.

- Access Free Gold & Silver Guides.

- Count on a Price Match Guarantee.

- Stay updated with Real.Time Metals Pricing.

- Receive a Free Evaluation on Metals from Others.

Cons:

- directed IRAs come with a nominal annual fee.

- A minimum purchase requirement is in place.

Precious Metals Available:

- Palladium

- Silver

- Platinum

- Gold

Minimum Investment:

$25,000

Company Background:

Lear Capital has been dedicated to ensuring your long.term financial security since 1997 when they established themselves as a leader in America’s precious metals industry. They are committed to earning and maintaining your business by providing exceptional service. Whether you’re looking to diversify your portfolio with bullion, high.quality rare coins, or authentic gold and silver for an IRA, Lear Capital has a strategy tailored to your needs. Whether you want to adjust your asset allocation, safeguard against global market volatility, or plan for retirement, they’ve got you covered.

Lear Capital understands the various investment options available in the rare metal market and streamlines the buying process for you, making transactions quick and easy. They offer a personal account manager, secure order placement, and provide real.time updates on spot prices, precious metal news, and economic events that could impact your retirement and future.

Lear Capital takes pride in their AAA Business Consumer Alliance rating and is recognized as a PCGS Authorized Dealer, ensuring accurate coin grading. They adhere to the coin grading criteria established by the Numismatic Guaranty Corporation (NGC) and align with the Industry Council for Tangible Assets (ICTA) on matters related to taxation, IRS rules, and tangible asset laws.

Invest with Lear Capital and experience the peace of mind that comes with their long.standing commitment to financial security and exceptional service.

>>>Click Here for Free Gold IRA Kit Lear Capital<<<

What is a Gold IRA and Its Benefits?

A Gold IRA, also known as a precious metals IRA, is a retirement account that allows individuals to invest in physical gold, silver, platinum, and palladium as a means to diversify their retirement portfolio and safeguard their wealth against market volatility and inflation.

Gold IRAs offer investors the opportunity to hold physical precious metals within a tax.advantaged retirement account. This unique form of investment provides a hedge against economic uncertainties and geopolitical risks. One of the key benefits is the potential for long.term growth and wealth preservation, especially during times of economic downturns or currency devaluations.

Reputable companies such as Augusta Precious Metals and American Hartford Gold have established expertise in helping individuals in setting up Gold IRAs. They offer guidance on IRS regulations related to precious metals, ensuring compliance with the rules and maximizing the benefits of such investments. For those looking to diversify their retirement savings, the option to roll over funds from a traditional IRA or 401(k) into a self.directed IRA for gold investments opens up additional avenues for retirement planning and wealth protection.

How to Rollover Funds into a Gold IRA?

Rollover processes into a Gold IRA can be accomplished through direct or indirect rollovers, adhering to IRS regulations and guidelines for retirement accounts such as 401(k) plans and self.directed IRAs.

Investment Options in a Gold IRA

Investment options in a Gold IRA encompass a range of precious metals such as gold coins, silver coins, and gold bars, which can be securely stored in IRS.approved facilities to preserve the value and integrity of the assets.

When considering silver coins, investors can diversify their Gold IRA portfolio by acquiring renowned choices such as American Silver Eagles, Canadian Silver Maple Leafs, or even historic pieces like Morgan Silver Dollars. These coins are not just valuable numismatic items, but they also serve as a stable store of wealth, providing a hedge against economic downturns and inflation.

Similarly, gold bars offer a tangible and secure way to invest in gold within a retirement account. These bars typically come in various sizes, allowing investors to tailor their investment according to their financial goals and risk tolerance. With their high liquidity and intrinsic value, gold bars are favored by those seeking a solid, long.term investment strategy.

It’s essential to consider the security and compliance aspects of storing physical assets in a Gold IRA. Selecting IRS.approved custodians and secure storage facilities is crucial for safeguarding the precious metals within the retirement account. This not only ensures compliance with IRS regulations but also provides peace of mind knowing that the assets are protected against theft, loss, or damage.

Tax Implications of Gold IRA Investments

Gold IRA investments carry specific tax implications and potential penalties that individuals need to be aware of, requiring adherence to IRS regulations and the selection of an IRS.approved custodian to manage the retirement account.

When investing in a Gold IRA, it’s crucial to understand the tax implications involved to avoid any penalties or non.compliance with the IRS. The IRS lays out strict regulations for retirement account investments, and failure to comply can result in substantial penalties.

By choosing an IRS.approved custodian, investors ensure that their Gold IRA is managed in line with the IRS regulations, safeguarding both tax compliance and the overall financial security within the retirement account.

Benefits of Investing in a Gold IRA

Investing in a Gold IRA offers numerous benefits, including the potential for secure storage of physical assets, protection against inflation, and the preservation of wealth for long.term retirement savings.

With the ever.growing concerns about economic uncertainties and market volatility, Gold IRAs provide a tangible and reliable option for diversifying one’s investment portfolio. Gold has historically maintained its value, serving as a hedge against market fluctuations and currency devaluation, thus offering a shield against inflation.

Holding physical gold in an IRA ensures that the precious metal is stored in a secure and regulated environment, providing peace of mind for investors. This type of investment aligns with individual financial goals and long.term retirement objectives by offering stability and potential growth, making it an appealing option for those seeking to safeguard and grow their wealth.

Final Thought – 401K to Gold IRA Rollover

A 401(k) to Gold IRA rollover is a smart way to diversify retirement savings and protect against economic uncertainty. Adding gold to your portfolio offers stability and potential growth. However, consider tax implications and choose the right Gold IRA provider.

Companies like Augusta Precious Metals and Goldco provide personalized service and a wide product range. Understanding direct vs. indirect rollovers is essential, with direct rollovers being simpler and tax-friendly. Ensure this aligns with your financial goals and risk tolerance. Consult a financial advisor to fit this strategy into your overall financial plan for a secure retirement.

For more information on 401K to Gold IRA Rollovers, check out my detailed review. You’ll also find my assessment of Augusta Precious Metals helpful, along with my article on the leading precious metals companies in the United States.

These resources are designed to guide you through the process and help you make informed decisions.